One of the hottest topics in dinner conversations of late has been Hongkongers

shopping or even spending weekends in Shenzhen, even major media channels are reporting

the phenomenon (eg. in SCMP and

NYT).

The scale of the outbound outpouring is not restricted to just Guangdong of

course, given how locked down HK has been during 2020-2023, and how strong the

HKD has risen against other currencies of late.

This thirst for new and affordable cuisines and services should not

have escaped the attention of any ambitious PRC brands – in fact the southbound

march has begun in earnest already (as seen in this Singtao piece).

We have found some examples of recent PRC brands opening here:

|

Figure 1: MuWu BBQ |

Figure 2: HeFu

Noodle |

|

Figure 3: Tai Er Pickled Veg Fish |

Figure 4: Tan Yu |

So how big are the potential inroads these Mainland brands can make

in HK? We start by looking at a Top 100 PRC Restaurants for 2023, which covers

some 219,000 outlets nationally to assess likely

impact of shop openings in HK. The top 30 names from the list is shown here

alongside their scores and franchise sizes:

|

Table 1: Top 100 PRC food & beverage brands and their cuisines |

Charting

food preferences in China

By analysing the breakdown of the top F&B chains into their

cuisine and types of foodstuffs, we are able to peer into the modern taste of

the Chinese urban population at large.

First, by cuisine, Sichuan cooking has the highest number of chains

operating across China (16 of them, followed by beverage brands at 13, see blue

bars below):

|

Chart 1: Top 100 PRC brands/outlets by cuisine |

Sichuan cooking is also the 3rd highest cuisine by number

of outlets (orange marks above), closely following beverages at #1 and

American at #2.

Together, almost 30% of Top 100 PRC F&B outlets offer

Sichuan and Guangdong cuisines. Most surprisingly however, of the 23 cuisines

charted above, Shandong and Jiangsu ranked #23 and #19 respectively despite

their reputation as part of the ‘eight major cuisines of China’!

Made

to order & fast food dominate food types

When it comes to type of foods, it is unsurprising to see

people wanting their individual tastes catered for, resulting in cook-to-order (also known as 小菜) chains ranking first by brands (1st

blue bar below). We think this more labour intensive way of catering should

be dominated mostly by smaller chains in the list, not to mention millions more

even smaller eateries not in the top-100 list.

The next biggest entries are all easy to cater, volume

business type foodstuffs, such as hotpot, beverages, fastfood, burger, pizza,

and the like:

|

Chart 2: Top 100 PRC brands/outlets by food type – mostly fastfood varieties

|

Also unsurprising is how these fastfood outlets – handshake beverage,

Chinese fast food, fried chicken, Chinese braised meat (or 滷味) – given the

economies of scale due to fast turnover and large volumes came high in the

ranking of number of outlets (orange marks above).

Why is Guangdong cuisine so underrepresented?

Despite the freshness, high creativity, and widespread

availability around the world, it was surprising for us to note that Guangdong

cooking was probably the most underrepresented cuisine in the top-100 list:

|

Chart 3: Brand % vs outlets % - high penetration from fastfood vs low presence from Guangdong |

In fact, as is clear from the chart above, Guangdong

cuisine is the furthest away from trend in relative proportion of branches as

well as outlets. This unexpected pattern might be explained by the need to have

fresh ingredients many of which from warm climate, and proliferation of seafood

dishes which call for proximity to the ocean, and possibility of the more

skilled preparations required (eg more frying rather than braising) which

limits the availability of proficient cooks being available to staff the

kitchens…

Drinks

and mass fast food items dominate market shares

In the food type domain, the same factors are at work in

deciding which type is abundantly supplied (fastfood category food, see blue

labels below) compared to those serving cook to order food (red label)

where complexities in diners’ orders results in a smaller number of brands

operating but is compensated by higher number of outlets (in fact the highest

category by food type):

|

Chart 4: Brand % vs outlet % - Food Items |

How do Shenzhen

and Shanghai measure vs national average?

We next look at how brands enter top

cities (we chose Shanghai and Shenzhen) to gauge how each city has its own

appetite, as well as if opportunities exist for under served cuisines in these

cities.

It is interesting to note that in

Shanghai, the over populated brands (red names below) appear to be

dominated by listed companies from HK and benefited from easy access to capital

market for their expansion plans. On the other hand, the underpenetrated brands

tend to be regional brands which may have a lower mind share or ‘prestige’,

thus explaining their under penetration in Shanghai (ie population implied

outlet numbers are much higher than actual outlets, eg. Shuyi and CHAGEE):

|

Chart 5: SH - population implied outlets vs actual outlets |

The pattern is even more interesting in

Shenzhen – the one phenomenon that stands out here is how the city is highly

penetrated by local brands and cuisines – Hakka and Guangzhou already point to

the geographical proximity of their cuisines, while ZhenGongFu and Muwu are

both locally grown brands:

|

Chart 6: SZ – population implied outlet numbers vs actual |

HK

to see a torrent of new entrants yet

Set aside the

fact that HK may be at equilibrium in its number of F&B outlets, the large

number of PRC hopefuls to establish a bridge head here, or simply to use HK as

a marketing medium given its international status, should suggest that a large

number of the top F&B brands in China will continue to come this way.

So how do we

estimate the likely inflows? With Hong Kong and Shanghai both being gateway cities,

it may well be a good proxy to use the Shanghai F&B population as a proxy

of likely concentration of eateries present there already but not yet entered

HK yet. Below is the result of our projections:

|

Chart 7: SH population implied outlets vs actual numbers in HK |

Funnily, the Shanghai concentrations suggest that

Café De Coral is over populated in HK, and could be in need of some trimming in

numbers. However in its place there are dozens of just the top-100 brands that

will want to open up here, as shown by the whole bank of orange marks on the

left. All of them, given their own concentration in Shanghai already, should

mean hundreds of new arrivals in HK in the months and years ahead – the thinner

arrow above suggests each brand with >10 outlets, and those behind the

fatter arrow suggests single digit openings.

Applying

the SH mix to HK, here is a league table of top brands that need to open shop

here:

|

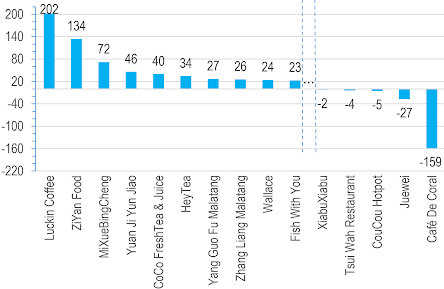

Chart 8: HK brand potential – most likely entrants and leavers charted |

The results are an incredible number of new beverage

outlets to come, at roughly 300 stores from the above chart! Factors outside

the above quantitative analysis however must be factored in when making

predictions, for example, how heavily penetrated are local HK coffee shops

already – you can hardly not bump into specialty barista cafes anywhere you go

these days, have they already filled the gap of the Luckins of the world? What

about the local traditional herbal tea brands that may reduce demand for mass

PRC milk tea offerings like HeyTea?

On the flip side of likely inflows, we may have an

oversupply of brands in HK such as Juewei which specialises in duck necks (?!),

and local champions like Café de Coral may also see leakage of its traditional

customer base as the HK product mix enriches with new entrants…

Retail

demand from new entrants – not material

So how will this new onslaught of new brand

openings in HK bring in terms of new retail floor space demand? Our modelling suggests some 0.55m square feet of

new entrants from the top 100 brands, which when benchmarked against HK’s retail

stock at 130m square feet,

is but a rounding error – or a mere 0.45% boost. It is

exciting nevertheless as a consumer to see new offerings which increases

shopper choices and introduces new ways of eating/drinking which can only

enhance HK’s reputation as a ‘paradise of food’ even further…

The

author would like to thank Yeung Ching Wa Oscar from City University of Hong

Kong majoring in Finance for assisting in data collection and analysis of this

article.