Below is the English translation of an article published in the January 2014 issue of HKEJ Monthly:

Outlook of UK

Property amidst slow growth and tax crackdown

In recent months it

seems, whichever direction one turns, from newspapers to letterboxes and even

email inboxes, overseas property sales advertisement are omnipresent – be it

familiar markets such as UK/US/Australia/Canada, or Singapore/Malaysia, even

depressed Japan, or the sovereign debt troubled Spain/Portugal seem to be

selling properties in Hong Kong.

However, buying property

long distance already increases risks, let alone acquiring real estates located

in places of different languages or unfamiliar commercial/legal cultures. Extra

due diligence is therefore paramount to investment success. The writer tries to

stick to markets which are easier to understand, and the one top of the list

has to be UK. This article tries to look into various fundamental factors in an

attempt to increase readers’ odds should they be looking at overseas property

investing.

Where stands the UK property cycle?

The key advantages of

investing in property are its long cycles, and the lack of market/insider

manipulation like in investing in securities. As a result, one only needs to

invest at turning points of these cycles to generate long term and repeated

above-normal returns. Besides price cycles, another important indicator is

affordability, below we look at the UK market from the point of view of

valuation to determine if it still is a good time to take a plunge in this

market.

Home price to income

seem expensive, but mortgage affordability remain good

If left untouched,

the free market would have allowed prices to rise and fall by the balance of

forces between supply and demand, however, since the global financial crisis

(GFC), all governments around the world seem to have taken on the role of God,

trying all means at their disposal to prop up all sorts of asset markets. The

result is the loss of the price discovery mechanism and a general loss of

information content in whatever prices we see being transacted. In the case of

the UK property market, what should have been a 50% fall in price seemed to

have been arrested by the combination of zero-interest rate policy (ZIRP),

quantitative easing (QE), and fiscal stimulus (such as Help to Buy), resulting

in a rebound in prices after barely a 25% drop.

Currently, average

home prices in the UK are equivalent to 4.67 years of the average full time

worker’s income (Chart 1), and looks set to continue rebounding some 7% in the

coming year, with a chance of breaching the bubble high levels last reached in 1988/9.

This bounce in the national prices are too modest compared to London home

prices, which helped by external demand (of which China/HK money rank amongst

the top sources), safe haven effect (i.e. all European countries hit by tax

hikes and banking crisis, such as France, Greece, Spain), has been rebounding

strongly since back in late 2009, to have risen over 30% against income levels.

London’s price to income multiple now stands at 6.06, and could well reach the

top of the historic range around 2016 (Chart 2).

|

| Exhibit 1: UK house price to earnings ratio |

|

| Exhibit 2: Greater London house price to earnings ratio |

Whilst expensive in

price-income multiple terms, housing valuation needs also to be viewed in the

context of mortgage affordability (i.e. what proportion of monthly income is

used towards mortgage repayments). In this measure, the central bank’s ZIRP has

helped a great deal, and alongside recovering lending appetites amongst banks,

mortgage costs have steadily fallen in the past year, leading to the UK

mortgage affordability measure nearing historically low levels, and at almost

one standard deviation below historic averages (Chart 3).Over in London, the

stronger rises in prices have more than offset the magnitude of falling

interest rates, resulting in the London mortgage affordability measure rising

for two years in a row – even with another 16% rise in prices, the measure only

just returns to the historic average line (Chart 4).

|

| Exhibit 3: UK mortgage affordability |

|

| Exhibit 4: Greater London mortgage affordability |

The above two sets of

charts clearly illustrate that, without forceful administrative intervention,

UK home prices had more to fall; however, with interventionism and political populist

very much the mainstream philosophy, adding to that uncertain pace of economic

recovery, government support for the property market will likely remain the

main factor influencing home prices.

Home prices not

attractive if income and rental yields are factored in the equation

In order to combine

the income and interest sides of the analysis employed above to look at the

whole picture, we can combine the key home price drivers – income, interest

rates, and rental yields – into a ‘composite valuation index’ to reach a result

akin to that shown in Chart 5. Unfortunately, despite recovering income and

suppressed interest rates, rental yields have also fallen, resulting in the

composite valuation index to reach levels similar to the 2007 top already!

|

| Exhibit 5: Composite house price index: High |

In a still low

interest rate environment where government market support is unlikely to

withdraw, we are afraid that the trend in the next two years will most likely

be higher highs in the composite index, until around 2016 before a correction

will be seen.

Tight supply also

favorable to home prices

Besides

affordability, another key factor driving home prices is supply. In this

regards, the tight credit environment and slow economic growth has led to

falling completions; this combined with household formation remaining at

elevated levels, has pushed up UK occupancy rate back to the range seen in the

90s, or an occupancy rate of 96.6% (Chart 6) – this high occupancy rate will

benefit rents and prices alike. Looking at the planning permission figures of

the past three quarter, completions will likely stay low in the next six

months, at an annual rate of around 150,000, which is significantly lower than

the 200-220,000 levels before the GFC. Overall speaking, in the short term, UK

supply will likely stay below demand.

|

| Exhibit 6: Supply falls for 2 years, and occupancy rate increases |

|

| Exhibit 7: Completions for the 3 quarters will be low |

Economic growth – not out of the woods yet

The greatest

challenge to home prices in the future remains low real income growth (Chart 8)

which will restrain rental increases and therefore property prices. Further,

fast paced economic growth seen in the UK since the 80s (i.e. the portion above

the dotted line in the chart) may have coincided with financial sector

deregulation (i.e. Big Bang) and the peaking global interest rates in 1980.

Both these factors are now in reversal, with no prospects of improvements to

help the economy outperform.

Whilst in the short

term, low interest rates will continue to provide support, this remains an

artificial ‘life support’ mechanism which will one day be taken away, adding to

that the spectre of a Euro sovereign debt crisis, risks remain that home prices

could mean revert towards income (Chart 9).

|

| Exhibit 8: UK average real disposable income: no longer as strong as before |

|

| Exhibit 9: House price growth is higher than the growth of the economy and earnings |

Besides troubles in

Europe, it seems that the global economic growth engine that is the USA may

weaken – after over three years of recovery, the initial jobless claims numbers

may have reached a multi-decade low (red arrow in Chart 10). Whenever the initial

claims numbers start to enter a rising cycle, stock market indices stagnate or

even worse, enter bear markets. So, with the economies of two of UK’s most

important trade partners entering a period of high uncertainty, risks also rise

for UK’s economy and property market. The question remains of whether:

governments allow markets to falter (arrow B in chart) or another round of QE

saves the day (arrow A in chart)?

|

| Exhibit 10: US job market recovery may be about to end |

Fiscal difficulties + popularism = higher taxes have

only begun

Another important

factor that investors in UK properties need to increasingly take heed of is the

implication of structural budget deficits (Chart 11) brought about by high

welfare. When government debts are at the highest levels since the 60s (Chart

12), and when interest rates cannot fall further to reduce the debt financing

costs, higher taxes may be the only way forward.

|

| Exhibit 11: UK government has been in budget deficit since 1960s except for fiscal year 2000/2001 |

|

| Exhibit 12: UK net debt will not decrease until 2015/2016 according to Treasury's optimistic prediction |

Which sector is most attractive?As is common in many

jurisdictions, the need to appease domestic voters will continue to increase as

prices rise further, shutting out local potential home buyers. As a result,

punitive taxes aimed at overseas owners/buyers (such as the Mansion Tax) will

become more severe and more widespread – investors should be prepared for this trend

unfolding in the next two years as elections loom.

By this stage, we

hope to have highlighted the main pros and cons in investing in UK property. If

you have already decided to put money into this market, you will certainly have

heard all about buying location and quality (rather than cheap prices).

However, it appears that quality and premium products are now reaching levels

where the benefit no longer justify the cost – for example, West End prices

have already outperformed Greater London by over 30%, and an even more

substantial 100%+ when compared to national average prices (Chart 13).

With the rush of

overseas buyers pushing prices to unreasonable levels, combined with the

government targeting luxury homes (eg those over 2 million pounds), property

prices in the more expensive districts have already started sliding, and looks

set to continue in this trend to at least the middle of 2014 (Chart 14), if not

as far as 2015/6.

|

| Exhibit 13: West end house price increases faster than London and England & Wales |

|

| Exhibit 14: West end/London price ratio is high |

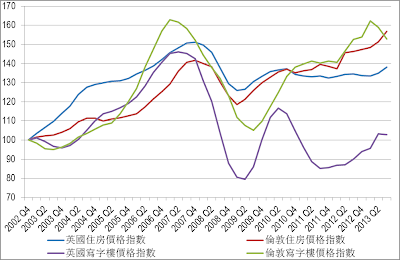

Given this possible

outcome, what you see in your letterboxes (most likely in the most expensive

parts of London) will probably not be an outperforming asset in the near

future. For good value sectors, office property outside of London may have

better upside (Chart 15).

|

| Exhibit 15: UK office price (excluding London) is still cheap |

The author wishes to thank Mr Simon Zhu’s help in

assisting in the collection and analysis of information used in this article.