Following the USDC depegging, triggered by custodian bank bankruptcy, it is opportune to re-examine the quality of stable coins on the market (which we do at least 3 times a year as a matter of course), and the results are summarised in today's missive below...

There are many levels of risks attached to stablecoins, and the table below looks at 3 aspects:

a) how often and how reliable are issuers audited - obviously USDC has the most prestigious auditor in the form of Deloitte, followed by BDO which issues reports on assets for USDT. This is cold comfort however when SVB itself is audited by KPMG, another big-4 firm...

b) how liquid are the asset backing - here USDC does best with almost all collateral in the most liquid category of assets (cash or short term TBs), followed by USDT (only 18% in longer dated TBs), while DAI is mostly in cryptos (but still 64% being USDC backed);

c) who are the custodian banks - here it is very hard to gauge whether bigger banks are better (more liquidity?) or worse (more complex derivatives books?), but since most of the issuers do not disclose this information (the USDC one only came to light following the SVB crisis), there is no easy way to quantify the counterparty risk at all...

For tradfi supporters, USDC still presents the best protection; for crypto maximalists however, DAI could offer a better solution (but needs to rid itself of tradfi backing to be purist - ie use BTC/ETH as asset collaterals rather than USDC/GUSD and the like).

What about hedging with derivatives?

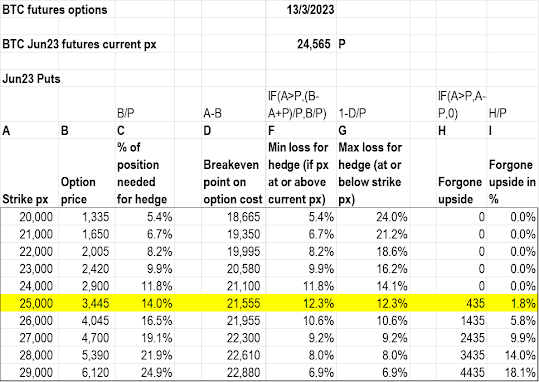

Aside from avoiding volatility by parking in stablecoins, another way might be to buy put options for downside protection. Below we have done a scenario based on today's prices:

Sadly costs are too steep for hedging under normal circumstances - as can be seen in 3rd column above, for at the money hedging, 12-14% of the portfolio needs to be sold to buy the protection...

So we are back to stablecoins then...

As a result, it seems we are stuck with stablecoins for now, and our hope remain that when BTC becomes big and liquid enough to absorb all hedging activities, perhaps we will have a working decentralised and purely crypto based hedge.

Until that day, here is our updated risk metric table - for now USDT and BUSD seem to be better scoring given the high volatility seen in USDC in the past few days:

When combined by the qualitative factors discussed in the earlier sections, we will stick with USDC for now...

With the crisis now seemingly over, we are seeing all USDC trading pairs on the larger DEX platforms back to normal behaviour, eg:

Here are not small U$120k trade vs WBTC is attracting only a price impact of 0.24% on one of the several side chain pools. Hail decentralisation!

As we commented earlier also, the coincidence of crypto banks being brought down almost simultaneously is raising questions elsewhere as to whether the takedowns were coordinated - see article 1 below for more. In the end, just like centralised banks fail while decentralised crypto networks continue unfazed, perhaps this will be the norm years in the future?

Vignesh Karunanidhi | March 11, 2023

...Unfortunately, the banking realm took a hit with the fall of Silvergate Bank. The issues also escalated with the recent downfall of the Silicon Valley bank.

...Changpeng Zhao, aka CZ, recently put out a tweet highlighting the recent shutdown of cryptocurrency-friendly banks:

Pure speculation. It almost feels like there is a coordinated effort to shutdown crypto friendly banks.

Result?

Banks are shut down.

Blockchains still running.

— CZ 🔶 Binance (@cz_binance) March 11, 2023

CZ says crypto-friendly banks are being shut down

CZ speculates that it feels like there’s a coordinated effort to shut down crypto-friendly banks. The tweet is a follow-up to the recent downfall of two of the cryptocurrency-friendly banks, Silvergate and Silicon Valley Bank. These two banks had a significant relationship with some of the most prominent cryptocurrency giants. However, the relationship has taken a toll as the banks are no longer in play to provide their services to these cryptocurrency businesses.

Perhaps CZ also highlighted the result of this speculative shutdown of cryptocurrency-friendly banks. He mentioned in his tweet that the banks might be shut down, but the blockchains are still up and running.

One Twitter user commented on the tweet, stating that it’s time to stay united and that only CZ can lead the cryptocurrency community out of this darkness.

However, CZ mentioned that there is no necessity for leaders in a decentralized ecosystem, and he also stressed the fact that it works better without a leader.

沒有留言:

發佈留言