HK property is facing significant challenges, in the new reality of being increasingly viewed as 'another Chinese' city. Will this mean prices will fall more than its brethren in the north (or rise less if market turns up) henceforth? We look into a number of factors that influence the outcome of this interesting investment dynamic, perhaps starting with the bad news first: 1) Chinese outbound tourists bypassing HK (bad)? As more relaxations are introduced/restored for visa free entry to global destinations (right column in table below), PRC tourists may bypass HK even more and head for exotic climes directly: This trend of disintermediation, is also manifesting with more overseas countries given visa exemptions for visiting China (left column above), a factor further compounded by increasing flights from gateway PRC airports to overseas cities, reducing the hub role HK has long come to enjoy. 2) Rising retail standard + cheap RMB => surging northbound HK shoppers (bad) As amply illustrated in article 1 below, increasingly sophisticated retail offerings in PRC cities, more spacious physical hardware, (sometimes) better services, and of course cheaper cost is now triggering a new phenomenon where HKers go spend weekends in SZ for leisure and even for grocery shopping. In office space alone, more companies may be tempted by the now Grade A spec but much more affordable occupation costs up north:

HK office costs are still 3x prime SZ equivalents, which coupled with cheaper labour, may entice increasing numbers of businesses to set up north of the border - especially if travelling on the High Speed Rail, one can be in Futian from Kowloon West in a matter of 14 minutes, on fares (book yours here) cheaper than the cost of a cup of Starbucks ... It is worth noting also that occupancy costs fell across the board in the China/HK markets in Q4 23, compared to mostly rises in other global cities - showing how weak the domestic economy was then, and why the Chinese govt had to pump prime to save the property sector in recent weeks. 3) PRC rate cuts vs Fed rate hikes (bad) We have long maintained that wars and deglobalisation will only worsen inflationary pressures, and that this would leave little to no scope for rate cuts by the Fed:

What's more, the still high real interest rates in China allows it ample further scope for credit easing - some 150bps vs US, and nearly 280bps vs UK):

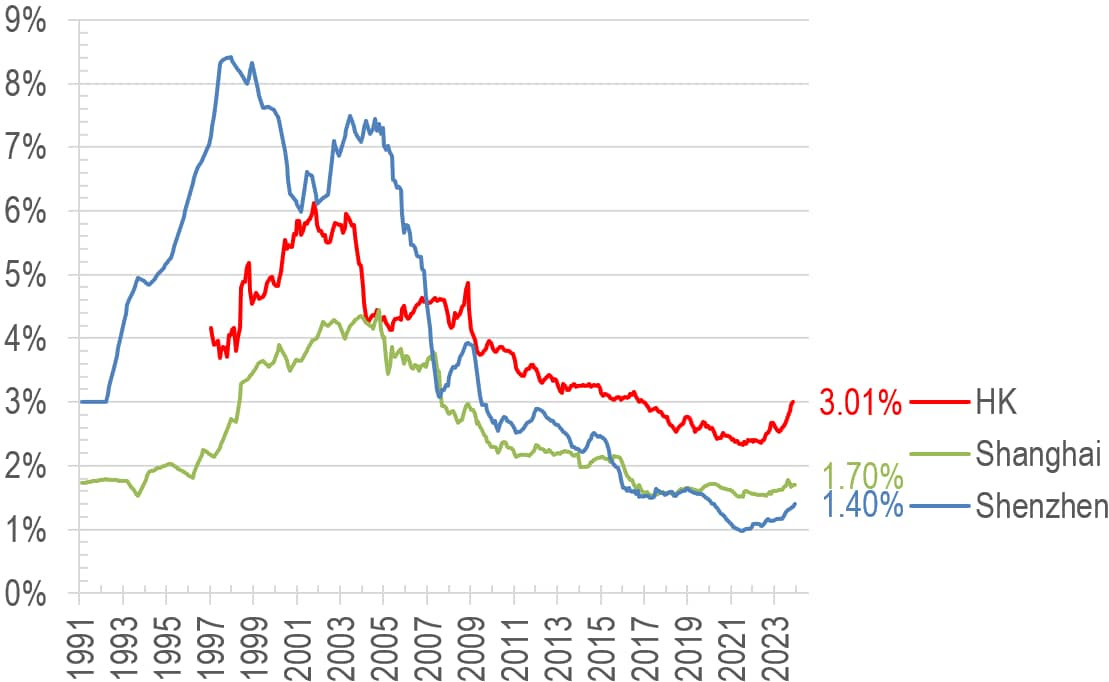

The conclusion of this rate trend divergence is best illustrated in the chart below: Whenever HK rates hike less than PRC rates (green arrows pointing up, eg 1992, 2006), HK prices tend to rise much faster (red arrows up). The reverse is the case when HK rates rises more above PRC rates - which is where we are now - prices underperform SZ (eg 1996, 2013 to date). With the rate picture increasingly looking like HK rates staying high while China cuts further in the coming year (rightmost green arrow above), HK residential premium over SZ will likely shrink further in the coming two years. 4) Facilitating Southbound flows (good) The HK govt has been tapping into the rise in PRC wealth and talent by attracting them to settle in HK (article 2), but this is not radically different from some other immigration schemes already in place, and perhaps does not have as strong an impact as in earlier years. Similarly, attracting more southbound shoppers is nearing its potential (we already have 49 cities on easy travel arrangements, see article 4), and thus will unlikely result in any quantum leaps with further relaxations. 5) Higher SZ base good for higher HK too (good) As can be seen below, the premium in HK prices remain quite substantial over SZ for comparable luxury estates (Residence Bel Air in HK vs Seaworld Shuangxi Garden in SZ): Whilst global comparison suggest that our current 120% premium may be too high - eg NYC Midtown is 50% premium over San Fran, and 63% premium over NYC Downtown - perhaps the shrinkage of the HK-SZ premium is largely done. Hopefully SZ price increases will do most of the catch up work rather than even deeper HK price drops... Looking forward, we think a combination of the two remains the most likely scenario; here the Price-to-income ratio trends suggest that SZ prices will improve by some 12% in the coming year or two whilst HK might see a larger 30% correction. For HK, the bulk of the improvement will have to come in price correction rather than income growth: 6) Yields already safer than many global cities (good) A saving grace for HK at least is that its real property yield is already quite 'reasonable' when viewed in the context of real property returns: Above table is updated to December, showing that high inflationary pressures in places like Tokyo and London is destroying returns on rentals, whilst both SZ and HK sit reasonably happy in positive territory near the top of the pile. Generally high real return markets are more sustainable pricewise than -ve yielding ones. The higher nominal yield in HK (3%) also means that the higher interest rates here in the longer term will make for a healthier market when SZ's paltry 1.4%:

7) final technical look - SZ might do better medium term? On a long term technical perspective, SZ could continue to play catch up, but we await price action to give the next signal (either pierces the green support or breaks out of the blue resistance) before jumping into investment action. The answer might show itself by as early as mid-2024:

Given various headwinds in primarily geopolitics, perhaps investors are best to diversify into commodities and low conflict risk jurisdictions, exactly what we have been doing for the past 2-3 years... ==================Article 1================== Hong Kong vs Shenzhen: a day of food, drinks, sightseeing and leisure compared – how much cheaper can the mainland Chinese city be?The recent jump in people heading from Hong Kong to Shenzhen at the weekend suggests you can enjoy a lot more for much less in the mainland Chinese city... ==================Article 2================== Facilitation measures on two-way flow of high-end talents within the GBAThe Hong Kong Special Administrative Region Government and Mainland authorities have been exploring means to further facilitate the two-way flow of talents within the GBA, including “northbound” flow of non-Chinese Hong Kong residents.... https://www.info.gov.hk/gia/ ==================Article 3================== China cuts 5-year mortgage rate by record margin to aid property sectorThe People's Bank of China lowered the five-year rate to 3.95%, from 4.2%, marking the first reduction since last June... ==================Article 4================== 消息指中央同意擴大自由行來港 有議員料納入更多二三線城市現僅49個城市居民可自由行來港 部份省份無份原文網址: https://www.hk01.com/article/ English Google translate here. |

2024年2月23日星期五

Will HK fall more than SZ? 20240222

Labels:

disposable income,

HKSAR,

inflation,

mortgage rate gap,

PRC,

property price,

rate cut,

RMB,

Shenzhen,

tourism,

visa,

yield

訂閱:

發佈留言 (Atom)

沒有留言:

發佈留言