聲明:所有傳媒發布的訪問內容只代表撰文者之理解,可能與本博客作者的分析或結論不同,或存有偏差。

General Disclaimer - where quoted in media reports, your correspondent does not exercise control on editorial policy and therefore what appears in the publication may not coincide, or even rarely, contradict your correspondent's views...

載於2024年08月29日

Bricks & Mortar Management王震宇:特朗普當選 港樓始有望回穩

【明報專訊】目前市場憧憬本港下月開始將跟隨美國減息,住宅樓市將會止跌回穩,地產股股價近日亦已率先反彈,後市是否真的否極泰來呢?去年5月初因應地緣政治風險升溫而看淡本港樓價的Bricks & Mortar Management主席兼總裁王震宇現仍維持審慎,他指未來兩年東北亞出現戰爭的風險不容低估,美國國債或會被拋售,10年期國債孳息率或升至雙位數,衝擊全球投資市場,亦不利港樓後市。他強調,除非特朗普勝出11月美國總統大選,取代現時的主戰派執掌白宮,減低全球戰爭升溫風險,始可考慮低吸港樓。

本港樓價去年首季回升近7%後,4月已轉趨橫行偏軟,Bricks & Mortar Management王震宇去年5月4日在本欄見報、題為「買港樓自住 要不怕樓價跌」專訪中認為,美國政府近年由主戰派當道,前年俄烏戰爭爆發後,未來兩三年東北亞出現戰爭的風險亦不容低估,提醒本港樓價有下跌風險。當時他表示:「若你的目標不是保本、唔驚樓價跌的話,覺得買樓自住帶來的安全感高於資產回報的重要性,你便去買吧!」該專訪見報以來,中原城市領先指數由去年5月初165.08點急跌逾16%至上周五138.61點,見近8年低位,可見王震宇測市準確。

珠玉在前,記者近日再邀請王震宇接受訪問分析港樓後市,而他仍然維持審慎:「美國11月進行總統大選前,我估計會有不少出乎意料的事件發生,原因是目前掌控白宮的主戰派不會容許共和黨候選人特朗普入主白宮,點樣可以達到此目的呢?主戰派料繼續在烏克蘭燃點戰火,以及令中東局勢進一步升溫,不排除導致緊張狀態,因此推遲甚至取消總統大選;即使順利舉行總統大選,最終亦可能像4年前般出現選舉結果爭議,各式各樣的可能性令是次總統大選充滿不穩定性。」

美日菲澳聯合軍演 勿低估東北亞戰爭風險

日本在1945年第二次世界大戰投降後,軍隊及軍事機構分別解散及撤銷,而在1947年頒布的憲法規定,日本不能擁有軍隊,因此自衛隊在法律意義上僅限為部隊而不是軍隊。

王震宇認為,在上述背景下,日本今年4月卻與美國、菲律賓和澳洲在南海舉行聯合軍事演集,類似而規模較少的聯合軍事演集近月仍持續,要思考背後的動機,故他相信,未來兩年東北亞爆發戰爭的風險不容低估。

國際投資者若拋售 美長債息率或見雙位數

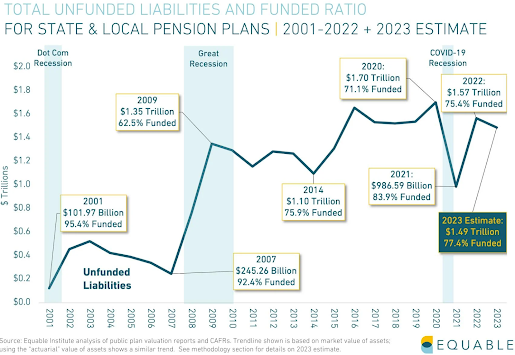

除了全球戰爭風險升溫外,王震宇指出,由於美國政府過去一段長時間揮霍無道,需要發債填補巨額財赤,故目前國債規模逾35萬億美元,已超越立國以來以對數(Logarithm)比例運行的區間以上(見圖),這反映美國國債上升程度已經較內戰、第一次世界大戰及第二次世界大戰時快,這也代表美國現已很接近賴債邊緣。故王震宇認為,假如美國日後在全球參與戰爭規模擴大,令財赤進一步升溫,國債違約風險亦飈升,或觸發國際投資者拋售,屆時美國10年期國債孳息率或由現時的4厘以下升至雙位數,衝擊全球投資市場,本港樓市亦難免受累。

由於美國現時已債台高築,王震宇認為,即使未來2年東北亞不爆發戰爭,美國國債在未來5至10年的違約風險也不容忽視,他形容這是一或兩個世紀才會出現一次的大型危機,投資者宜密切留意事態發展。

特朗普主要關注經濟 與俄朝領導人友好

王震宇強調,美國11月總統大選非常重要,原因是假如特朗普獲勝,而他亦在明年1月順利重返白宮再任總統,料會改變美國現時主戰的作風,減低全球地緣政治風險,「回顧特朗普在2017至2020年出任總統期間,他關注的主要是經濟問題,故他不單與俄羅斯總統普京維持友好關係,亦與朝鮮領袖金正恩拍膊頭,這當然可以減低地緣政治及戰爭風險。」

記者翻查數據,本港樓價在2017至2020年期間錄得近兩成升幅,而2021年以來則跌近兩成。王震宇總結,只有中美關係好轉,本港樓價才有機會止跌回穩,故值得花時間真真正正去研究美國政治,尤其要關注特朗普能否勝出11月美國總統大選。

【明報專訊】Bricks & Mortar Management王震宇認為,除地緣政治風險升溫等外圍不利因素外,本港樓市亦面對政策風險。根據本港房屋局數據,2024/25至2028/29年度公營房屋預測建屋量達14.68萬個單位,當中,逾三分之一屬資助出售單位。

王震宇分析,問題是目前私人住宅樓價已處於下跌周期,政府把如此龐大數量的資助出售單位推出市場,難免會令樓價跌勢加快,料未來3年會是市場最困難的時間,他又稱:「未來3至4年私樓潛在新供應達10.9萬伙,近歷史高位,政府的新供應也在這時間釋放出來,你估樓市會唔會冧呢?」

「代表私樓所有上車盤無運行」

有分析認為,政府對資助出售單位的買家設有入息及資產限額,因此資助出售單位未必與私樓競爭,但王震宇不同意,他認為:「即使設有入息及資產限額,但政府資助出售單位大增,也代表私樓所有上車盤無運行,這也會拉低比較高階的樓價。」

明報記者 葉創成