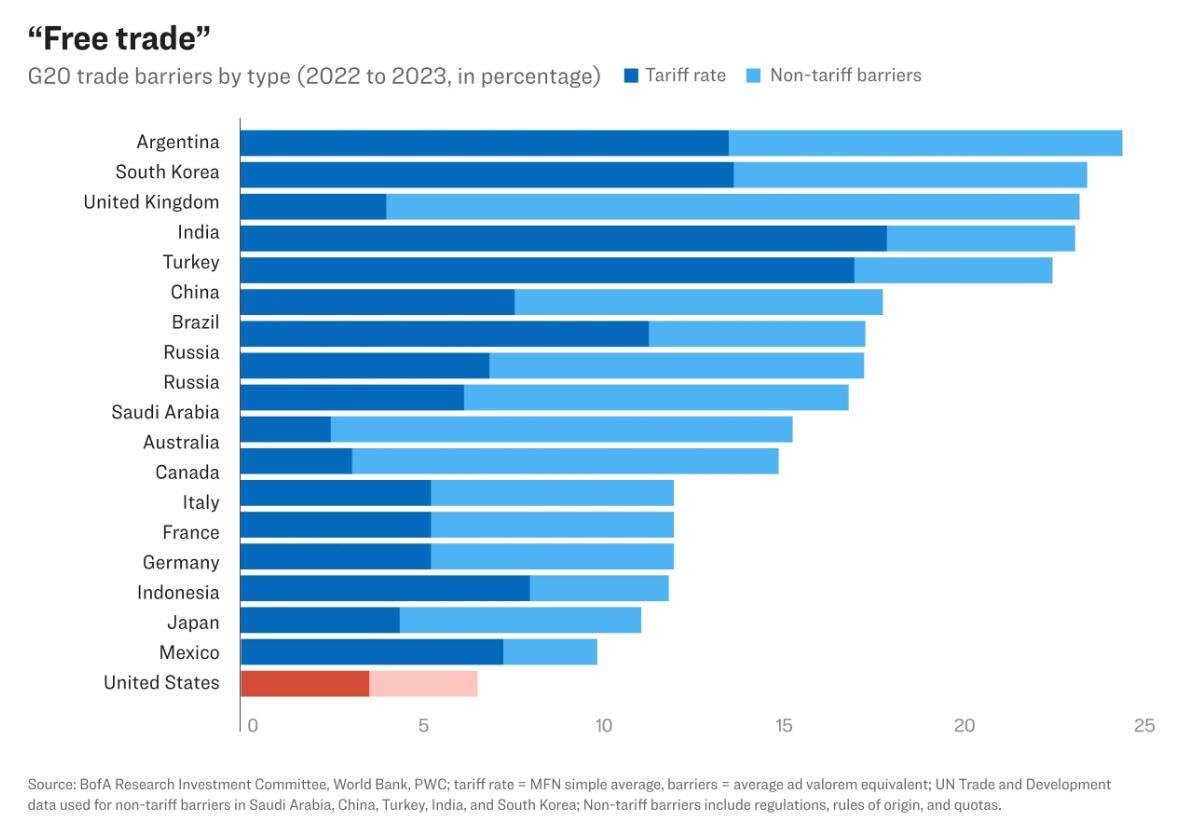

The much awaited 'by country score card' of US tariffs is finally out overnight (see article 1). What is clear is the US's determination to level the playing field, as it has been 'ripped off' by trading partners which have far more punishing trade duties/barriers than US:

The distribution of the tariff rates can be seen from article 1 as well, but here is the global distribution from low tariffs (green) to high (red) - it is obvious that the whole Asian export complex is hit, even US's traditional allies S Korea and Japan: Most hurt of course are the SEA nations which have received much offshoring and reshoring investment in recent years. But what the currency markets have reflected are positive surprises for Japan and Switzerland (blue circles), while Thailand and S Africa (red circles) may have been more punished than expected: Whilst not surprising, the US also closed the loop on China's small parcels route to exporting given earlier brief tariff imposition which was quickly reversed. To show how big the Chinese parcel export industry has become, this is an excellent chart: Yes you got it right, out of top 20 cities that sell on Amazon, only 7 cities are non-Chinese, which take the top 4 spots by a wide margin... By trade bloc impact assessment Below we have broken down the impacted nations by trade blocs - OECD (orange), SEA (blue), and N Asia (green): The key impact columns are 4th from right, indicating which country is hit hardest within that bloc: EU was punished hardest in OECD, while Cambodia/Laos/Vietnam hurt most in SEA, and China/Taiwan both are bruised more than peers. On a total economic materiality basis (5th column), top 3 hit countries are Cambodia, Vietnam, Taiwan. The latter being the most surprising entry in our study... Obviously this is just Trump's opening salvo, and as the 'Art of the Deal' requires, give and take will eventually result in a quite different set of results from this announcement. We await the wide ranging negotiations to begin from today... obviously the more flexible the country is in its executive decision making, the quicker they will reduce the impact of these reciprocal tariffs... Our guess is that most SEA nations fall into this category. Response above are from these sources: A) Japan - Seeking exemptions and negotiating with U.S. counterparts. B) European Union - Postponed counter-tariffs and prefers a negotiation. C) Canada and Mexico - Exempt from baseline tariff but concerned about broader impacts. D) China - Retaliatory tariffs and suspended export permits for certain U.S. soybean producers. ======================Article 1=================== We now know the full extent of Trump's reciprocal tariffs. They’re huge.April 3, 2025 “Liberation Day” turned out to be alarming. President Trump floored investors by announcing the largest tax hike on Americans since at least the 1940s. [...] The April 2 announcements included two sets of import tariffs. One is a new “universal” tax on imports from everywhere. The average tariff rate on imports at the start of the year was about 2.5%. So the 10% universal tariff on its own would raise the average tariff to 12.5%. That would be the highest since around 1940. [...] Americans bought about $3.3 trillion worth of imports in 2024. The tariff rate of about 2.5% yielded a tariff tax bill of about $83 billion. Investing firm Evercore estimates that all the new tariffs combined will push the tax rate on imports to about 29%. ======================Article 2=================== Trump signs order that closes duty exemptions for cheap shipments from ChinaApril 3, 2025 [...] The order says Trump is ending duty-free treatment for the covered goods imported from China and Hong Kong starting at 12:01 a.m. ET (0401 GMT) on May 2, according to a fact sheet provided by the White House. ======================Article 3=================== Morgan Stanley Sees Tough Road for Trump Deals With China, India[...] China is the most exposed to these tariffs, followed by India and Vietnam, according to a research note sent to clients on Wednesday. These three countries could also find it more challenging than other economies in the region to sign a pact by April, according to analysts led by Chetan Ahya. [...] “President Trump’s focus on fixing the US’ large and persistent trade deficit means that Asia will be exposed,” the analysts wrote, adding that much of the risk to the region’s economies will come not just from the direct hit of the tariffs. “The indirect effects of tariffs matter more – that is, the persistence of trade tensions will weigh on corporate confidence, capex and trade.” |

2025年4月3日星期四

Macro - Liberation Day winners & losers 20250403

訂閱:

發佈留言 (Atom)

沒有留言:

發佈留言