Posted on 14th December, 2019

Stand News :

The perception that Hong Kong’s traffic congestion is worsening by the day is no new sentiment to the road users of the city, and one of the most obvious solutions to this problem has been, and will continue to be, the extension and intensification of the metro rail network.

This article explores how HK compares with other global cities in its metro rail provision. But before we start, a quick look at how land use is distributed between the various modes of transportation may already provide an answer to the question: Do we have enough rails already?

Land allocation alludes to rail under-provision

As the chart below illustrates, land used by railway is barely 0.4% of total, compared to 4.2% of land dedicated to roads. For roads to occupy 10x as much land area as rail but only carries 1.6x as many passengers (rail passengers number 5 million, and are 38.5% of total daily trips), HK’s transport policy priorities is clearly misdirected.

Chart 1: Land use of roads is

over 10x that of rails in HK

|

Which city to compare HK to?

Whilst relative land use gives an idea of appropriateness versus other forms of transport, whether the absolute level of rail coverage is right would be best tested against other cities.

When measuring up HK’s railway provision to other global cities, the usual crop of candidates spring to mind, but we believe London may be the most appropriate ‘rival’ given that both cities are international financial centres and global cities, as well as similar populations (HK’s 7.4m vs. London’s 8.6m) and even population density (HK at 6,480 people/km2 vs. London at 5,518 people/km2). What’s more, average salary for Hong Kong (US$2,716/month) and London (US$2,773/month) are also comparable.

In the below analysis, we will compare HK’s rail coverage to London’s, by and large, while making passing comments on other cities where relevant.

Rail length per urban area: HK in the short

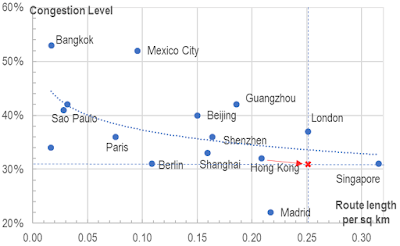

The more area a city covers, the more rail would be required to service that area. We therefore start with this measure to compare whether HK is providing sufficient rail footprint; here we use road congestion (high congestion means insufficient rail services) as the second parameter:

Chart

2: Area density in rail length at London levels may cut congestion by 3%

|

The TomTom congestion level for 2018, defined as the amount of extra travel time spent by drivers across the entire year, suggests that the city is doing relatively well, but with rail density behind London (Chart 2), perhaps improved coverage will lead to lower congestion levels? The correlation here suggests a small improvement of some 3%.

Based on the above correlation, Hong Kong may need to build an additional 46.7 kilometres of metro rails to match London on the route length/km2 measure.

Route length per head – even more increase needed

Another way to measure rail density may be to compare the length of the railway network to the city’s population, as shown in Chart 3 below. Again, increased rail provision to London levels could reduce the city’s traffic congestion overall by 9% or so:

Chart 3: Per capita route length at

London levels may cut congestion by 9%

|

Based on the above correlation, Hong Kong may need to build an additional 127.1 kilometres of metro rails to match London on the route length/head measure.

Best measure – combine area with population: HK still inadequate

Land area and population by themselves may not truly reflect the living density of people in the city, so we combined these to produce Chart 4, which plots route length as measured by each city’s population density:

Chart 4: London level

route-population density may cut congestion by 9%

|

One clear observation is that cities with low railway coverage, such as Bangkok and Mexico City are plagued with very high congestion levels. Although HK is relatively lucky in that regard, we could again improve the rail provision levels to London’s standards. In this case, the reduction in congestion would again be in the 9% region, similar to the length-per-head measure.

Based on the above correlation, Hong Kong may need to build an additional 331.2 kilometres of metro rails to match London on the route length/population density measure. This is the highest of the three approaches employed above. So how much is 331km of rail?

HK needs to double its railway network to get to Beijing/Shanghai levels

To reach London levels, HK needs to build 43% of its existing system length (Chart 5), but this is not the world leading rail advancement known in Tokyo – to be like Tokyo’s route length / population density, HK needs to build two times more of its current network!

Chart 5: Hong Kong to build 331

km more railways to reach London’s level

NB: Hong Kong’s total route length is 231 km as of October 2019

|

All this goes to show how backward the planning mentality HK’s transport framework is, and how much more remains to be done.

One further perspective to analyse the level of rail provision may be looking at the ridership metrics, as shown below:

Chart 6: Hong Kong to extend the

railway by 46% with reference to New York’s level

|

Again, Sao Paulo is a clear case of under-provision, resulting in ultra-high intensity of use over a short/limited network, while at the same time too few citizens per capita get to enjoy the convenience of metro rails.

On the other extreme, the New York-London-Madrid axis perhaps are the closest to best class rail planning – with more riders per head, but lower number of riders per kilometre of rail. The sardine packing pictures so distinguishing Tokyo and Hong Kong clearly have room for improvement!

If HK was to reach New York level of route length while keeping the same level of ridership/population, some 336.8 km new rails need to be laid here (or 46% of current network capacity). This curiously, is very close to the 43% increase suggested for London using the per-population-density measure.

Let us stop issuing ever more car licences like the HKSAR government has been doing, and start digging some rail tunnels.

The author would like to thank Cherry Lui of The University of Hong Kong for assisting in data collection, analysis, and drafting this article.

Sources: